Markets are aligning to real demand

Does the increase in the share of affordable housing launches of sub-Rs 40 lakh units mean a price correction?— Ankit Sharma

Market is yet again aligning to actual end-user demand for more affordable units. Many cities, including the Delhi NCR, are registering this trend, which is here to stay.

A recent ANAROCK-CII Report, “Affordable Housing: The Blue-Eyed Boy of Indian Real Estate”, says that the Delhi NCR and the Mumbai Metropolitan Region (MMR) account for 55% of the total 6 lakh affordable units launched across the Top 7 cities with the NCR claiming the maximum supply. With 3.98 lakh units sold in sub-Rs 40 lakh category, the NCR and the MMR hold 57% share.

Data from ANAROCK also suggests that affordable housing spearheaded the new supply in 2017 and 2018, comprising 45% and 40% of the units, respectively.

IS THIS PRICE CORRECTION?

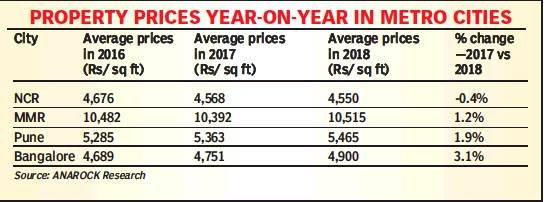

Experts say there has been pressure on prices instead of correction. Santhosh Kumar, vice-chairman of ANAROCK Property Consultants, says: “There has been more of a time correction rather than a price correction, with average property prices across Top 7 cities registering a meagre 1% increase. Given the prevailing market conditions over the last few years, price correction would mean a significant drop in the average property prices. But, as per ANAROCK data, trends don’t clearly indicate that. In fact, the average prices across top cities has seen a marginal rise, up to 3%. However, considering inflation (at around 7% a year) all cities will see negative price trends.”

“Also, developers actively looking to clear their unsold stock in the market were offering discounts while sitting at the negotiating table,” he says. Unit sizes have been resized, too.

MIXED OPINION

“Prices have been under pressure for quite some time now, in the entire country. With increase in the tax slab in the Budget, followed by rate cuts in GST, market has seen a lot of buoyancy which would surely increase housing demand upwards. Increase in demand will result in upward revision of prices. Also, with input tax credit restricted, prices will rise by nearly 3-5% in the next financial year (2019-20),” Manoj Gaur, MD of Gaurs Group and VP of Credai National, said.

Others differ on the issue of price correction.

Pradeep Aggarwal, chairman and founder of Signature Global and chairman of National Council on Affordable Housing, Assocham, says, “Last year, prices in the Delhi NCR fell by around 2%, which was not substantial, though prices in resale market fell by around 15%.” ANAROCK data suggests a visible price correction in the secondary market though.

“The secondary market did see a correction, ranging between 10% and 15%, largely because investors preferred to exit the market rather than hold on to their stock. This was seen in tough markets like the NCR.

Markets are aligning to real demand

“But Bangalore was more resilient and corrections in this market remained below 10%, that too only when investors were keen to exit,” Kumar of ANAROCK said.

OUTLOOK

Rates are expected to remain subdued because of high inventory across key cities, which will prevail in the coming quarters too. This will bring more discounts and offers for serious buyers.

“Due to the reforms, housing sales have been low over the past few years, which prompted developers, especially those looking to clear their unsold stock, to offer discounts and freebies to lure homebuyers,” Kumar says.

The NCR is a prime example of this trend. Serious buyers looking for a property in this range can plan their purchase accordingly.